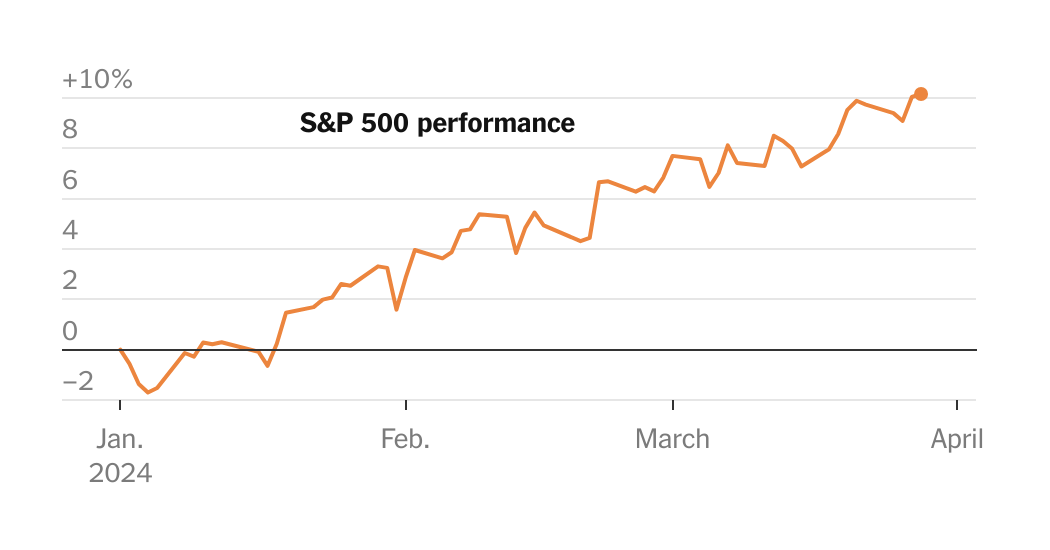

It’s been a blistering start to the year for the stock market.

The S&P 500, one of the most widely watched stock indexes in the world, has risen more than 10 percent over the first three months of 2024, buoyed by 22 record highs.

Roughly 40 percent of the stocks in the index are trading above where they were 12 months ago. And even when the index has lost ground, it hasn’t been by much, with only three days so far in 2024 in which the S&P 500 has fallen more than 1 percent by the close.

The move has been driven by renewed appetite for stocks. Investors in March poured roughly $50 billion into funds that buy stocks in the United States, according to data from EPFR Global.

A modest rally in January, based on expectations the Federal Reserve would start cutting interest rates this year has given way to more widespread optimism that the central bank could bring inflation down to its target of 2 percent without inflicting too much damage on the economy — the long-hoped-for “soft landing.”

A fresh reading on inflation and spending released on Friday was in line with economists’ expectations, reinforcing the prevailing forecasts for Fed rate moves. “We don’t need to be in a hurry to cut,” Jerome H. Powell, the Fed chair, said at an event on Friday.

In the markets, exuberance has spread to the riskier corners of the financial system. Bitcoin continues to trade above $70,000, a threshold it reached for the first time this month after regulators made it easier for ordinary investors to buy funds that track the price of the cryptocurrency. At the same time, mergers and takeovers have surged and the public debuts of Reddit and Trump Media were greeted with big pops in share price on their first day of trading. And in credit markets, where investors finance companies via bonds and loans, the demand to borrow and the desire to lend have swelled — a sign of optimism over the outlook for corporate America.

Even with the Fed contemplating cutting interest rates as many as three times this year, by as much as three-quarters of a percentage point in total, the returns on offer to investors remain well above those found elsewhere around the globe, helping keep money flowing into the United States.

“I am seeing it from all over the world,” said Andrew Brenner, head of international fixed income at National Alliance Securities.

But Mr. Brenner also sees reason for caution. Cracks are emerging in the economy, with consumer finances beginning to wane. Credit card debt has been rising, and the number of people behind on their car loans has surged at the quickest pace in more than a decade. Some companies are also beginning to struggle, with the number defaulting on their debts more than doubling last year, according to S&P Global.

The Russell 2000 index of smaller companies, a measure of firms more susceptible to the ebb and flow of the domestic economy, also rose over the first three months of the year, but by just 4.3 percent. It’s a reminder that the biggest companies are driving the stock market higher — especially those surfing the wave of optimism over artificial intelligence.

“Stocks are working for people right now,” Mr. Brenner said. “I just wonder how long until we run into some trouble.”

The so-called Magnificent Seven group of stocks that drove the market higher last year continued to have an outsize impact, responsible for almost 40 percent of the S&P 500’s rise over the first three months, according to data from Howard Silverblatt at S&P.

However, steep drops for Apple and Tesla meant that an even smaller cohort of companies — Nvidia, Meta, Amazon and Microsoft — pushed the market to new heights. They were responsible for half of the index’s gain on their own.

“Earnings are good, interest rates are off their peak and employment remains high, with consumers willing to spend their paychecks,” Mr. Silverblatt said. “So the market continues up.”