Former President Donald J. Trump’s already sizable stake in his social media company is set to jump by more than $1 billion, as he’s rewarded with additional shares in the parent of Truth Social — the result of its stock price staying high in recent weeks.

The windfall comes at a crucial time for Mr. Trump, who is on the hook for hundreds of millions of dollars of legal bills tied to the multiple cases against him. The presumptive Republican nominee for president is also ramping up his political campaign, with the boost to his net worth bolstering his image as a wealthy businessman, an important part of his pitch to voters.

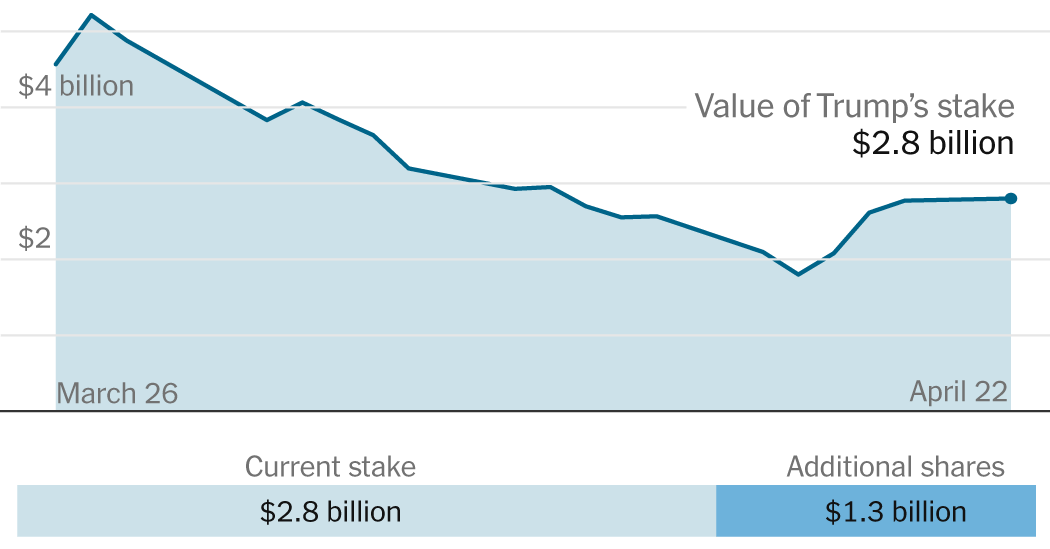

Mr. Trump is already the largest shareholder of Trump Media & Technology Group with 79 million shares, a stake currently worth nearly $3 billion. He’s now due 36 million more shares under what is known as an “earnout,” additional stock that would push the value of his stake to over $4 billion.

Earnout shares, a feature of mergers, are designed to reward insiders if a company’s stock performs well for a set period after completing a deal. Trump Media merged with a public shell company last month and made its debut on the Nasdaq on March 26. The new shares would raise Mr. Trump’s stake to about 65 percent of the company.

An initial frenzy pushed the value of the company up to nearly $8 billion, but the share price has fluctuated wildly since then, falling by about half from its peak. Trump Media has been a popular target for short-sellers, who make money by betting on the decline of a company’s share price.

Despite the ups and downs, Trump Media’s share price has remained above the levels set as triggers for awarding extra shares to Mr. Trump and other shareholders. The shares are awarded in batches, based on whether the stock trades above $12.50, $15 and $17.50 for 20 out of any 30 days in its first two years as a public company. The stock, which closed at $35.50 per share on Monday, traded well above all three of those thresholds since the March debut, and on Tuesday was on track to meet the conditions of the earnout.

As with the other shares he owns, Mr. Trump is not yet allowed to trade them or use his stock as collateral. With the stock at its current price, Mr. Trump is required to wait 150 days, or until late August, before he can sell any of his stake, though the shares could be traded earlier if Trump Media’s board were to waive the restrictions.

The company filed to register millions of potential new shares last week, a routine procedure that nonetheless spooked investors.

Typically, the registration of new shares like this tends not to cause much market reaction, but the unusual ownership of Trump Media, which includes retail traders and loyalists to Mr. Trump, has led to sharp swings in its stock price. If a flood of new shares were to hit the market, they could jolt the stock price again.