As officials at the Federal Reserve weigh whether and when to cut interest rates this year, they have been hoping to see evidence that the labor market is gradually cooling but with unemployment remaining low.

The jobs report released Friday carried bad news on all fronts.

Hiring and wage growth both accelerated in May, according to the report. That could add to fears that the labor market remains too hot to bring inflation fully under control.

But unemployment rose slightly, hitting 4 percent for the first time in more than two years. That suggests high interest rates could be starting to take a toll in the form of increased job losses.

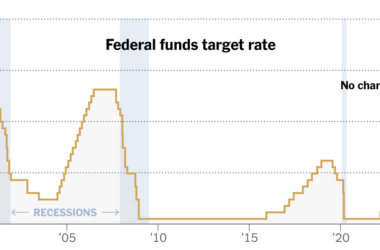

Policymakers will meet next week to weigh the economy’s conflicting signals. They are widely expected to leave interest rates unchanged at about 5.3 percent, their highest level in decades. The same is true for their next meeting, in July.

What happens after that is much less certain. Investors think there is about a 50 percent chance that the Fed will cut rates at its September meeting, but those odds have steadily worsened in recent months as inflation has proved more stubborn than policymakers had hoped.

Fed officials are paying particularly close attention to wage growth, which has fallen since the frenzied days of 2021, when businesses were trying to rapidly hire workers as the economy reopened from the pandemic. But pay is still rising significantly faster than before the pandemic, and while policymakers don’t believe that is a primary cause of recent price increases, they are concerned that it will be hard to bring inflation fully under control unless wage growth slows further.

“If you have wage increases running higher than productivity would warrant, then there will be inflationary pressure,” Jerome H. Powell, the Fed chair, said at a news conference after the central bank’s last meeting, in May. He said that policymakers had “seen progress” on wages but that “we have a ways to go on that.”

The data released on Friday showed that average hourly earnings, a measure of wage growth, rose 4.1 percent in May from a year earlier. The pace was faster than in April, and faster than forecast. That, combined with job growth that was also much stronger than expected, could make Fed officials more concerned about the job market remaining too hot — and therefore more reluctant to cut interest rates.

But the increase in unemployment could give some policymakers pause. So far, the Fed’s campaign of rate increases has brought remarkably little pain in the form of job losses, and the unemployment rate remains low even after the slight uptick in May. But historically, once the unemployment rate rises even modestly, it tends to keep rising.